Scoring model

As a rule, there are more proposals for product development projects in any company than available resources. So how do you choose the right ones among the many alternative proposals?

The scoring model

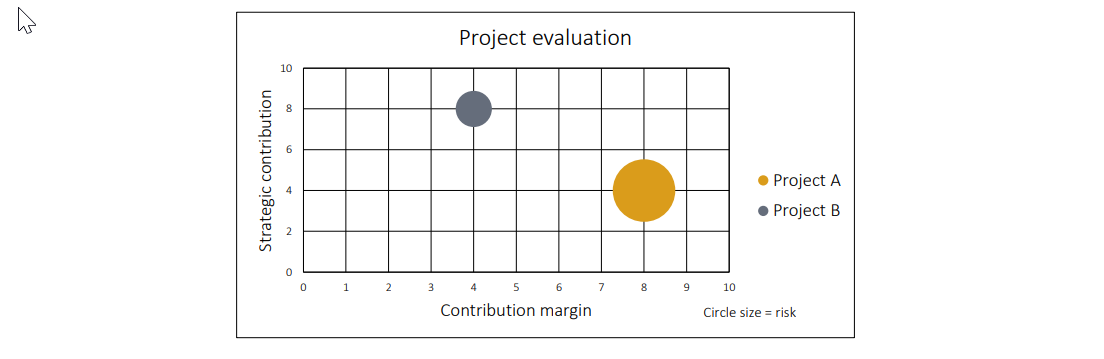

A pragmatic approach is to use a scoring model with three evaluation dimensions. This allows you to rank your projects in a way that maximises the value contribution of your product development budget:

- cash value of contribution margin

- strategy contribution

- risk assessment

In a scoring model, these three criteria are evaluated individually for each project, e.g. from 1-10, then multiplied by a predefined weighting and subsequently added together. In this way, each project receives a point value that corresponds to its priority in the project list. You accumulate the resources needed to implement the projects and determine the limit at which your self-defined utilisation limit (work-in-progress limit) is exceeded. You can implement the projects above this limit. The others you cannot.

Cash value of the contribution margin

Here, every company has its own very specific contribution margin calculation. You decide which contribution margin you want to use. Build a business case template that includes estimates of expected sales and sales prices. Then put these in relation to the omission alternative. On the credit side, you may only value what the respective product generates for you in terms of additional turnover and contribution margins. On the cost side, you evaluate the one-off costs of the project incurred with the development and market launch.

Strategic contribution

To avoid a subjective and perhaps manipulative assessment of the strategy contribution of a project, we suggest a simple matrix. List the specific business objectives of the company or your business unit in the columns of this matrix. Weight the individual goals. Now list all the projects to be evaluated in the rows of the matrix. Then enter the strategic contribution of each project to each strategic objective in the respective cells. E.g. 0=no contribution, 1=low contribution, 3=medium contribution, 9=high contribution. Form the product sum from this assessment and the respective weighting of the strategic objective. You get a value for the strategic contribution. If you put this value in relation to the project budget, you will find out how much strategy contribution you receive per euro invested.

Risk assessment

The risk assessment should be as comprehensive as possible. Consider development risks, e.g. related to technological or conceptual risks; market risks related to the expected sales and price development; sales risks related to the capacities and competence of your sales team for the new product; budget risks.

Your benefit

- You prioritise your projects

- You maximise the value contribution of your product development budget

- You get a meaningful risk assessment